- Home

- Deceptions

- Solar

- Thermal Audit

- Ventilation

- Sensors

- Governance

- Environment

- Reference

- Contact

- News

Cooperative Enterprises for

Newfoundland and Labrador

[Return to Policy Summary Page]

Background

The standard North American arrangement for business is the corporation. These tend to be amoral, sociopathic organizations whose singular goal is providing "value" to shareholders. This value is usually short term profit.

Young people are often told that they should follow the American Dream, start their own business and get rich. There are a fundamental defects with this line of thinking including:

- Not everyone can be at the top of a pyramid, getting very rich from the employees beneath - otherwise it wouldn't be a pyramid. Therefore, this is not a model for a healthy society with a large middle class.

- There are large financial barriers to entry into a new business. Financial institutions and investors are not usually interested in startup companies. Newfoundland has tried to help with The Research & Development Corporation, and Genesis Center and at the Federal level there is Industrial Research Assistance Program and The Business Development Bank of Canada. However, to avoid people collecting free money and squandering it, governments want some "skin in the game" and set a limit of funding from all government source at 75%. Unfortunate, someone with talent and equipment and especially young people, are hard pressed to come up with 25% of the cost to launch a sizable business.

- Business that are successful, or which have impatient venture capital backers, are often sold to the highest bidder. This is great for the owner, but all the monies invested by the government are often lost. Garrison Guitars of Newfoundland for example was sold to Gibson Guitars and every job was lost. Ironically, the Genesis Center touts this as one of their success stories.

- Growth in a sustainable society must average zero. Think about that one for a minute. Most of our thinking about financial growth and successful business centers around continuous growth. The idea of creating a stable business that cannot be sold and where everyone is paid well but which purposely has little excess profit is perceived as just crazy by investors. Have a look at the insanity of compound interest.

This leads to the ridiculous situation we have today. Thousands of Newfoundlanders graduate from Memorial University and our community colleges only to find there are virtually NO JOBS, and certainly nothing that requires the education they and our tax dollars just paid for. Count all the jobs posted at Jobs in NL and ask what are the educational requirements for these fifteen Chicken Catchers? Even if our highly educated workforce took every job at Kent, McDonalds and the local poultry farms, most would still be unemployed. Even positions like nursing whose services are in demand (e.g. hospitals are woefully understaffed) cannot find employment because the healthcare authorities have no budget to hire them. We have insane things like pizza shops full of employees with doctorate degrees in engineering but St. John's cannot re-engineer the failed Riverhead sewer plant. Tens of thousands of expats that would return if they could eek out a living on their home province. Something is clearly dysfunctional.

These problems are not unique to Newfoundland. Spanish youth unemployment is over 57% and France is at 25%. Things are getting worse everywhere as we enter the terminal decline phase of our oil and debt fueled industrial age. There is a silver lining though - we have the collective brains to create something better.

The cooperative structure outlined below, solves the following problems:

- The cooperative cannot be sold, so there can be no corporate takeovers

- They rapidly gain working capital by retaining 50% of profits which makes then financially stable and limits the need for banks. In many cases, they run their own credit unions.

- Employees received their portion of this working capital upon retirement in lieu of a pension

- There are no layoffs and wages are equitably distributed.

- Ten percent is reserved to support the community.

Some of the following may seem complicated, but once it is done somewhere in the province, others can simply clone them and wouldn't have to organize procedures from scratch, build accounting systems etc. Undoubtably, the first such cooperative in Newfoundland and Labrador would have modifications, but the general ideas would remain.

Mondragon Cooperative Enterprises

The Basques region of Spain has a distinct language and culture, and like Newfoundland, residents had little desire to leave for the large cities like Calgary or Toronto to survive. Out of desperation, the cooperative enterprise was developed and refined over the decades. These cooperatives survived the Great Depression and proved to be exceedingly successful organization models that could compete successfully with commercial enterprises. In many respects, they became a parallel government, running credit unions, hospitals as well as industry.

Cooperative enterprises are businesses that are owned solely by the current workforce workers receive cash salaries and receive a share of annual profits which is placed into a capital account. When workers leave the cooperative their capital is paid out in cash and their ownership position is dissolved.

Cooperative groups are sets of employee owned cooperatives that pool profits to minimize the collective risk benefits include risk sharing and a larger pool of capital to fund large investments factory expansion and infrastructure improvements groups usually have 6 to 12 members in a related sector like fish plants and aquaculture or wood pellets and forestry operations.

Salaries and Salary Spread

Salary is considered to be a share of anticipated earnings. Salary is monies paid in anticipation of future earnings to emphasize that salary is not an entitlement but a cash advance for value added activities that lead to business earnings.

The spread between the executive management and shop floor workers is less than 1 to 6 in large firms and 1 to 4 in small firms of 500 employees or less. Profits are distributed based on hours work and pay level and placed in a capital account. This capital is not paid out in cash like a salary but is retained until the worker leaves the guild or retires. All salaries are published.

Keeping things Small and Manageable

When a business unit grows sufficiently large it is spun off into a separate independent cooperative. To minimize risk the new cooperative receives exclusivity as a supplier to the parent cooperative for a few years and can join a cooperative group to pool capital. This is the opposite of what happens when large companies merge and promptly lay off people due to duplication of positions solely in order to make greater profits for wealthy shareholders and without regard for the cost to human capital. The following could be spin off examples:

- A fish processing plant coop whose salmon farm keeps expanding, spins off the salmon farming operation as an independent cooperative. The farm continues to supply the fish plant all it can process at a set price for a few years, after which it would be free to sell fish to other cooperative fish plants.

- A wood pellet cooperative which manages its own forest has an insulation fiber operation but the insulation market has expanded and become quite sophisticated. The insulation division is spun off but with a guaranteed supply of feedstock at a fixed price. The insulation division agrees to continue to buy its wood from the parent cooperative for a few years.

- A wind turbine coop's electrical division which manufactures generators grew to 500 employees and sold products world wide was able to survive on its own it would be separated into an independent cooperative as the exclusive supplier of generators.

Contract Labor for Temporary Needs

Contractors can be used. They are not members cannot vote in the general assembly and do not receive profit sharing distributions. Contract employees are not to be used solely as a cheaper form of labor or to avoid the cost of providing basic employee benefits. Contractors may join the cooperative credit union and receive the standard human resource benefits.

Distribution of Retained Earings

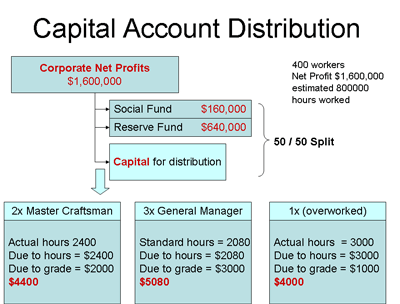

The arbitrary example below shows a net profit of 1.6 million. 50% of this is reserved as working capital. Every worker gets a credit of $1 per hour worked plus a bonus based on salary grade such that the $800,000 is completely distributed. These funds accumulate and are used for capital expenses like purchasing buildings. When the worker retires, his accumulated share is paid out in cash.

- 10% of profits go to the Social Fund. This might be used to build a childcare center (birth to nursery school), support a trade school program that outputs workers with skills needed by the cooperative, build and staff a nursing clinic, public library or publish consumer publications similar to Consumers Reports. There are no restructions - A guitar making cooperative might use its 10% to support the performing arts.

- 40% of profits are earmarked for salaries.

- The remaining 50% is placed into capital accounts for each worker on retirement. Workers get 100% of this in cash. The distribution is based on hours worked and salary grade.

The cash pool allows the cooperative to finance complex operations that would not otherwise be possible.

The general assembly and social committee determine the detailed profit distribution. Formulas are based on local circumstances.

No layoff policy

- 40% of net profit is retained by the cooperative as an emergency fund during an economic downturn. The governing council will determine the reduction in operating costs required to break even.

- After all other cost saving measures are adopted. 40% of the required savings will come from reduced anticipation of earnings (pay) with the remaining 60% coming from the reserve fund. It is the social committee's job to maximize such programs to ensure that worker needs are optimized.

- All salary grades will be reduced by an equal percentage and will be restored as soon as conditions permit.

Joining a Cooperative

Each member contributes the equivalent of one year's salary at the lowest pay scale 1x to their capital account at the credit union. Interest is paid at the standard rate for savings deposits the cash contribution can be borrowed from the credit union. The general assembly votes to accept new members. Capital is returned upon retirement or leaving the coop. 20% of the capital can be retained by the coop if the member leaves for bad reasons but this would have to be approved by the majority of the general assembly and would have to be something truly extraordinary to incur such wrath. This is not expected to occur.

Alternates to a cash contribution could be the loan of equipment need for coop production or 1 year of volunteer work. For a fish plant, perhaps someone owns a building, and another owns food processing equipment.

Organizational structure

A small cooperative wouldn't need all of this.

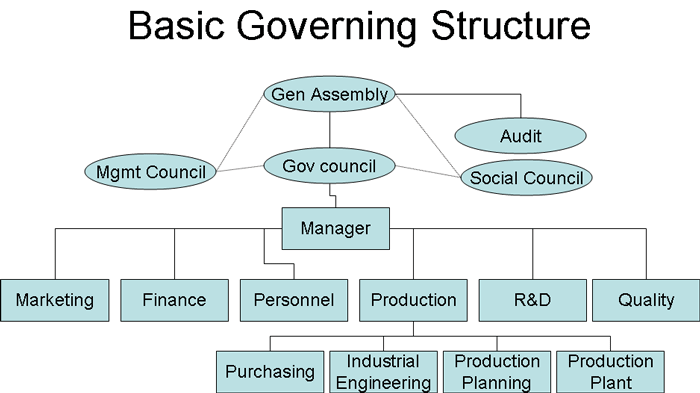

General Assembly

The entire membership of a cooperative meets once a year and is called the general assembly. Each member has one vote regardless of their position in the firm. Extraordinary meetings can be called by collecting the signatures of the majority of members.

The general assembly:

- Approves the annual business plan

- Allocates earnings

- Decides on mergers and acquisitions

- Votes on admission of new members and punitive expulsion of members

- Monitors performance

- Elects the governing council

Governing Council

The president, vice president and secretary of the general assembly along with several other members make up the governing council. It is similar to a board of directors except that all are members of the cooperative. Members are elected for a single term of 4 years. The governing council prepares annual plans, proposes distribution of profits for the general assembly, appoints and oversees the managers, determines job classifications, prepares annual reports.

General Manager

- The general manager is appointed by the governing council and is accountable to it.

- The general manager also is accountable to the general assembly which can vote to dismiss a general manager that is not performing well.

- Appointments are made for a term of 4 years.

- The general manager presides over departmental managers such as marketing, engineering and human resources.

Management council

This is a consultatory body that supports the general manager. It is made up of departmental heads and executives appointed by the governing council and the general manager. Social council workers are represented to management by the social council which is elected from the shop floor activities are similar to what trade unions do except unions see management as the enemy are usually adversarial and aren't commonly involved with business decisions in a single location coop. The shop floor workers are a major force in elections and can remove members from the governing council collectively, own most of the company and are all in the same boat so to speak.

These activities are therefore more cooperative than adversarial and include examining business plans and contributing proposals to management provide different points of view to management of to improve decision making analyzing and proposing changes to standard operation procedures, labor relations organization of work health and safety, monitoring annual evaluation of pay scales, keeping workers up-to-date on proposals for new products, informing workers about social council activities, allowing worker concerns to flow back up to management, analyzing methods to improve labor relations.

Regular labor union activities in private firms are performed on paid time. A mechanism must be provided to allow coop workers to take time off work and perform work on social council issues about 2 days a month is required. There will be a natural tendency for management to give floor level workers no time at all off production external non member professional consultation must be allowed a budget must be established for outside consultations. The shop floor workers are not accounting experts and may want to consult external experts. Usually the experts are in management and the same people being challenged. This annual budget should be sufficient to cover several hours of accounting, legal review and perhaps a site visit from a local professional engineer. This is an important function because if the workers feel strongly that something is wrong given their intimate understanding of detailed operations, it is likely an important concern to the cooperative. A simple majority of workers can disband the social council.

If their concerns are not acted upon there may still be a place for labor unions a union could accept dues from workers and provide consultation to the social council example management proposes a 2nd shift to boost production workers don't want night shifts the social council works on an alternative plan to improve throughput and hires and independent professional engineer to review advise and compare with management's plan the social council presents the new plan to management audit committee inspect all documents brought before the general assembly this function was originally required by Spanish law however it is a good idea for any business to guard against corruption this function should be term limited require a professional license such as a chartered accountant or lawyer and contain at least one non-member.

No doubt you will find a few anomolies in the notes above. Once the first such organization is created in the province, a detailed guide will be produced with legal documents, calculations, job descriptions, and procedures to comply with occupational health and safety, environmental regulations etc.

The role of Govenment is to be an enabler of self-sufficiency and to wisely spend its tax revenues to maximize value society. With that in mind, the following policies should be implemented.

Policy Items

- Amend the Companies and Corporation Act to include the worker owned cooperative

- Lobby to allow workers on employment insurance to work for a cooperative for a year to earn their entrance share. This is an excellent deal for society since that worker will likely pay EI premiums until retirement and never collect employment insurance again.

- Preferentially purchase goods and services from worker owned cooperatives when the product quality/price is equivalent to standard commercial offerings. This is a wise use of tax revenues since all of it will be retained in the province and the salaries re-taxed.

- Convert the remaining oil fired boilers in government buildings to biomass boilers to create a demand for biofuels and eliminate heating oil imports.

- Enact laws to ensure that all fish caught in Newfoundland waters be processed in the province and fight the ensuing legal battles as required.